5 Simple Techniques For Bad Credit Loans

Wiki Article

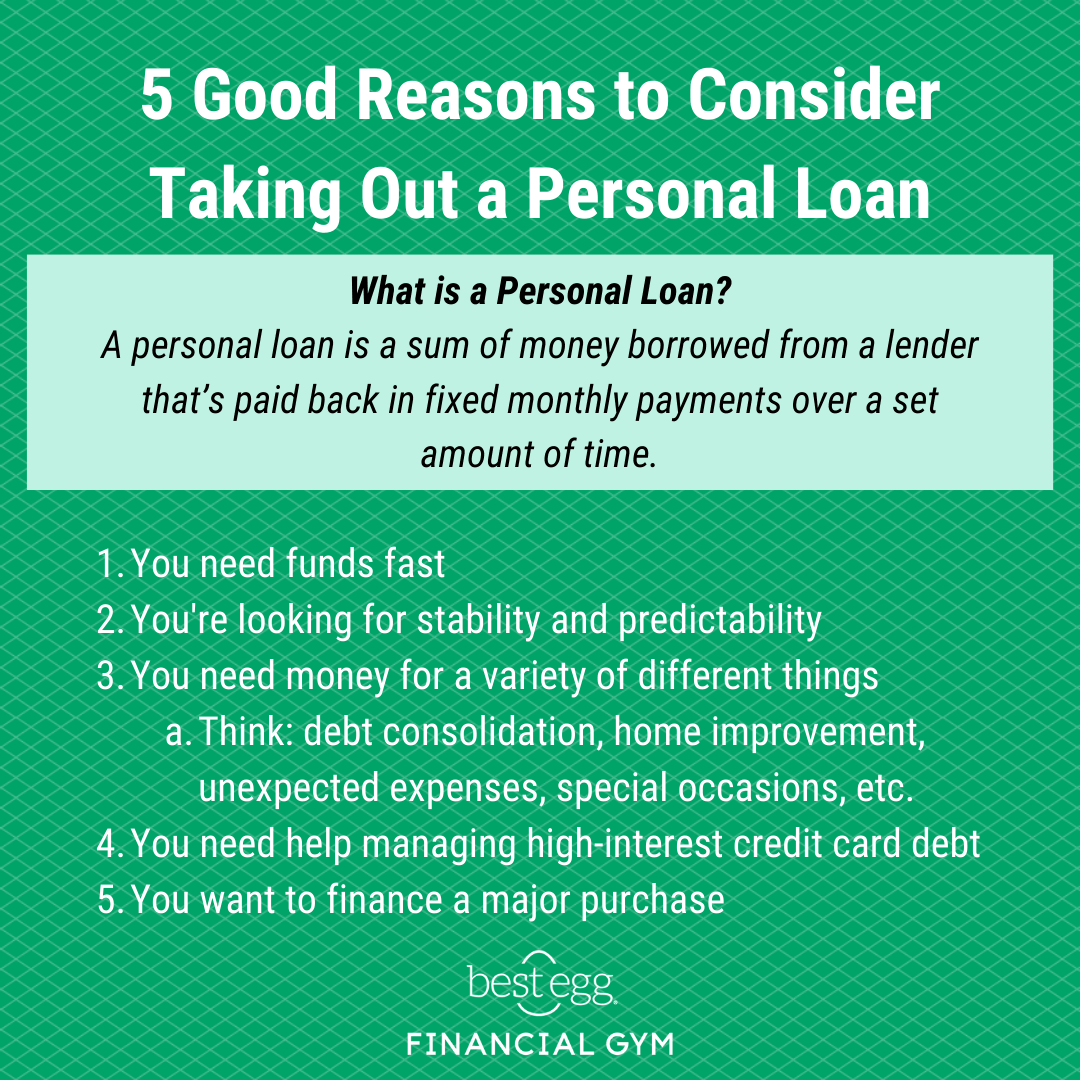

See This Report on Personal Loans

Table of ContentsLoan Consolidation Companies for BeginnersSome Of Consolidation LoansThe 9-Minute Rule for Funding HubWhat Does Loan Consolidation Companies Mean?

It's essential that you search with several lending institutions to ensure you obtain the very best deal on an individual funding. If you choose a finance with the first lending institution you discover, you could obtain a significantly higher passion price than you 'd get approved for elsewhere - https://justpaste.it/2u0ck. You may obtain a monthly payment that stretches your budget plan slim, as well as you can pay numerous hundred or hundreds of bucks extra in passion over the life of the lending.

The passion price, or cost of borrowing, is generally figured out by your credit scores rating and also lending term. A great credit rating score might additionally obtain you an affordable passion.

So, you should look for lending institutions that consider other aspects, like your work history or academic background, to have a better shot at obtaining a personal financing with an affordable rate of interest (Personal Loans). Does the lending institution cost application, source or prepayment costs? Relying on just how much you borrow, these expenses could build up instead quickly, even if they're rolled right into the lending.

The Only Guide to Loan Consolidation Companies

Do not let costs disqualify a specific lender. In some instances, the loan expenses could still be much less also if you have to pay some charges. What are the hours of operation for the lenders you're taking into consideration? Are they offered by phone, e-mail or conversation? Can you go to a physical location to obtain support? These are simply a couple of inquiries to consider as you evaluate loan providers to gauge if they're easily available.Nevertheless, individual financings are either protected (or call for collateral for approval) or unprotected. They also come with a fixed rate that stays constant or a variable rates of interest that transforms over time, and also many are marketed for a particular objective. Common categories include: are provided by loan providers to clients with past credit report challenges let you settle several debts with a new lending, normally with a reduced passion price, and also simplify the payment procedure by making a single monthly repayment are created to cover unexpected expenses and last-minute financial emergencies are made use of to make expensive upgrades to your home without using the equity you have actually constructed up Inevitably, the solution of the very best lending institution for you comes down to the lender's track record as well as the funding terms they're using.

With some research study and time, you can arrange from the finest personal car loan lenders to locate the one finest for your situation (Personal Loans).

Obtaining a personal financial institution financing accepted is not the simplest process. Taking into account recent financial difficulties throughout the nation, lending institutions are trying to find a lot a lot more in a finance applicant and also are much more rigorous. While there are numerous essential locations lenders will certainly be concentrating on, it is vital that you are ready to provide the excellent, complete bundle for testimonial if you want to obtain approved.

The Basic Principles Of Loan Consolidation Companies

Below are some on-line individual car loans suppliers you can select from: When you locate the car loan bundle you are most thinking about, speak to the financial directory institution straight to learn ahead of time what the demands are for financing qualification. You may need to make a consultation personally to review the necessary materials, records, and also timelines you will certainly need to start on the authorization procedure.Insufficient applications can be create for finance denial. Loan police officers have a specific protocol for accepting a funding and obtaining you the money.

Ask the loan policemans for guidance on complying with up. Your goal will be to safeguard a lending you have the methods to settle. You may additionally need to lay out the reasoning behind the loan. If it's a personal loan, the lender could need to know exactly how you plan to utilize the cash money, for instance, you might require it for home enhancements or financial obligation reduction.

It can be dangerous to your credit rating to continually look for simply any type of financing you think you may be able to get. Way too many financing applications can ruin your credit report and also obliterate your opportunities of safeguarding one in the near future.

Some Known Factual Statements About Small Business Loans

Those looking for individual fundings should initially begin their search by coming close to the bank and/or NBFC with which they already have a down payment and/or financing partnership. Their rate of interest rates as well as other financing functions can therefore be utilized as a benchmark versus which rate of interest supplied by other lending institutions can be compared.

Lenders supply different rate of interest to different clients depending on different variables such as credit report, employer's profile and also monthly earnings of an applicant. Some lending institutions likewise run special rates of interest uses throughout the festive season. The applicants having and above have higher opportunities of car loan approval as well as can bring reduced interest price (https://david-douglas.jimdosite.com/).

Report this wiki page